Cloud technology can help insurers revolutionise productivity, data-driven decision making, customer service and compliance.

- 8 in 10 (77%) brokers do not feel equipped to be as productive as possible

- 70% spend more than three hours per day on admin

- Brokers admit to finding it daunting to invest the time and money in new tech, yet a quarter (24%) believe this hesitance will cost them in the long run

Outdated tech is preventing insurers from keeping up with the unprecedented change the industry is facing, research from JAVLN, the cloud-based insurance policy management platform, has revealed.

The 2024 ‘Brokering Change’ report surveyed 500 insurance brokers at small and medium brokerages across Australia, exploring the big challenges today’s brokers are facing.

Brokers are being challenged on multiple fronts, from external factors like natural disasters, inflation and cyber breaches impacting insurance affordability to internal factors like increased admin time, complex compliance requirements and poor data preventing their ability to service customers effectively.

At the heart of these internal challenges is the slow adoption of technology. It’s no secret that insurance is a slow moving beast with decisions on technology taking longer than it should with stand alone or disconnected solutions.

But with almost 8 in 10 (77%) brokers saying they do not feel equipped to be as productive as possible – and outdated, antiquated platforms acting as a major blocker – why do these barriers still exist?

JAVLN spoke to several industry brokers and experts to delve deeper into this hesitance, finding perceived complexity and a lack of resource, data security fears and costs versus ROI the key inhibitors, as well as an overall ‘if it ain’t broke, don’t fix it’ attitude.

“It feels daunting to take the first step to move away from legacy systems and invest the time and money in new tech, even though most of us recognise the ROI and value this could unlock across all facets of our business,” one broker admitted.

Another broker shared the generational tension she’d observed, “As a younger broker, I’ve noticed my older counterparts are reluctant to learn a new system, even if they know it will help improve their productivity and service our customers better, faster and more efficiently.

I fear that if we don’t adopt technology, our challenges will only compound and grow. As an example, there’s no way our small IT team could compete on data security compared to an ever evolving, cloud-based tech provider.”

The Brokering Change report echoed this sentiment, citing the industry will find it challenging to attract and retain its future leaders if technology and automation isn’t up to scratch.

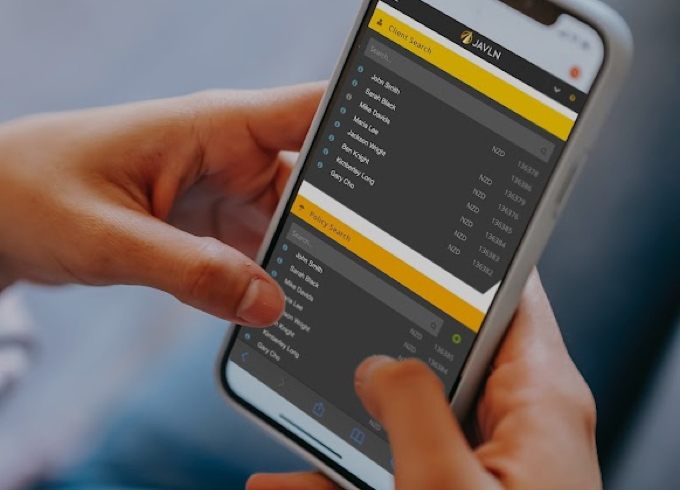

And it seems many brokers recognise the benefits of a modern and integrated cloud-based tech set up for managing clients and policies, with 30% saying it would be a real differentiator for their business.

Furthermore, a quarter (24%) of brokers now believe their organisation’s hesitance to turn to cloud-based technology for client and policy information will cost them in the long run.

David Leach, CEO of JAVLN, believes cloud based software-as-a-service (SaaS) technology is a turnkey solution to overcome the key challenges facing the industry.

“The path to a better, faster, modern and more customer-centric business demands adoption of new technologies that simplify and optimise our work by addressing those wasteful, mundane and repetitive tasks. Keeping up with tech creates competitive advantage and gives time back to focus on your customers.

For example, cloud software that connects to other cloud applications brokers use, streamlines workflows and removes a significant amount of duplication and manual handling. I wasn’t shocked that our research found 70% of brokers spend more than three hours per day inputting data in systems due to clunky, siloed technology. Imagine what could be achieved if they got this time back,” Leach said.

Leach added there are different ways insurers can adopt cloud technology, but argued the easiest and most sustainable solution was with a SaaS platform built natively in the cloud.

“JAVLN’s cloud-based SaaS technology offers productivity and compliance solutions to brokers. Ironically, the very barriers towards adoption are the top drivers for cloud migration: security, flexibility and ROI,” Leach said.

JAVLN customer, Trans-West, changed its tech stack and saw a 20% improvement in productivity and an 8% increase in average revenue.

Pieter Versluis, General Manager at Trans-West Insurance Brokers, said, “We were struggling with a fragmented system that made it incredibly difficult to get a full picture of our clients. Information was siloed in different locations, and there was no consistency in how we recorded client data, making it nearly impossible to provide the kind of client service we strive for. JAVLN has been a game changer for our brokerage.”

JAVLN is a NZ-founded insurtech company that is transforming the insurance industry by providing a cloud-based, end-to-end policy management solution.

Related Articles

-

The JAVLN Board has appointed David Leach as the new CEO, from Monday 14 October 2024. David will succeed JAVLN Founder and current CEO, Dale Smith, as he assumes the…Read more

The JAVLN Board has appointed David Leach as the new CEO, from Monday 14 October 2024. David will succeed JAVLN Founder and current CEO, Dale Smith, as he assumes the…Read more -

OfficeTech by JAVLN announces refreshed brand and software integration

JAVLN, the cloud-based insurance policy management platform, has announced the next stage of its 2023 acquisition of Technosoft Solutions’ document management and workflow software. The well-known Officetech suite of products,…Read more -

Data blindness ‘leaves brokers in dark’

A lack of access to clear client data is holding brokers back and making sales and customer policy management less efficient, insurtech JAVLN says. CEO Dale Smith told insuranceNEWS.com.au insured…Read more