By Dale Smith, CEO, JAVLN

Insurance brokers in Australia are at the coalface of a changing world.

On the one hand, natural disasters up and down the country are becoming more common and more severe, with more than 84 per cent of Australians being directly affected by at least one climate-fuelled disaster since 2019.

And on the other hand, Australians are facing the worst cost-of-living crisis for a generation. Now, insurers are faced with passing on premium costs to customers who are struggling to afford them, at a time when they need insurance the most.

Going above and beyond

It’s a busy time for brokers. And yet, perhaps unsurprisingly, despite the obvious challenges of sourcing the best terms and maintaining profitability in a cost-of-living squeeze, recent research from JAVLN shows that the biggest struggle for Aussie brokers is providing the right level of customer service.

JAVLN’s Brokering Change report highlights that identifying customer demands is currently the top challenge for 26 per cent of brokers, second only to insurance affordability at 28 per cent.

To stand out in today’s insurance market, customer service — and being a trustworthy advisor — sets the pros apart.

Naturally, brokers are looking to provide the best possible customer service by spending more time getting to know the intricacies of their client’s businesses and lives.

Broking has never been about simply processing a policy, but now it’s a matter of dedicating more time to going above and beyond for clients.

However, only 28 per cent of brokers say clients would rate their services at least an eight out of 10, while less than a quarter feel clients received better service from them than what they could have received from another broker.

The admin nightmare

But here lies the real issue: brokers are more than capable of servicing their clients, yet nearly 70 per cent of those surveyed for our Brokering Change report say they’re spending over three hours on admin each day.

Tasks I’m sure the industry is all too familiar with, like data entry and debtor management, are hindering brokers from making clients their number one priority.

Where else could these hours be spent? According to JAVLN’s research, brokers want to be able to spend that time on higher-value work.

- 38 per cent say they’d rather spend admin time bringing in new business,

- 36 per cent say they’d spend it on learning and development

- 32 per cent say they’d love more time to diversify their client portfolio

- 32 per cent say they want to spend more time managing insurer relationships.

So, how do brokers find the time to service clients? Many are realising that the secret to customer service is unlocking productivity.

Higher value priorities

Finding ways to streamline tasks to free up time to concentrate on higher-value priorities is key to achieving more. It’s the best weapon in a broker’s arsenal. The first step to freeing up time is identifying what drains it.

For many brokers, the issue lies in outdated technology. We’re seeing legacy platforms act as a barrier to completing the work that matters, but the risk-adverse nature of the industry means advancements are slow.

The clunky tech our industry has become so accustomed to is confusing at best, and downright restrictive at worst.

The bottom line is that Aussie brokers are facing a stressful time. So, how can we ease the headaches of compliance and admin to deliver great customer service?

The answer is leaning on technology that amplifies the work brokers are already doing. For tech to be a help — not a hindrance — there are three areas it needs to address:

1. Enhance productivity

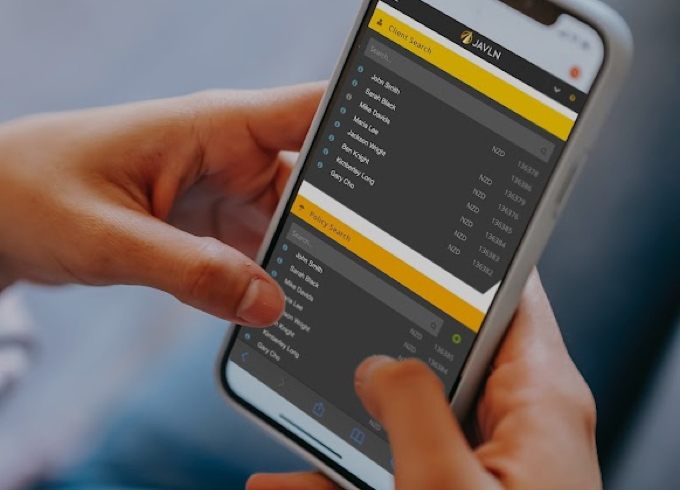

It makes no sense in this day and age for client policy and claims data to live in separate systems.

This way of working makes it incredibly difficult (and time-consuming) to marry up different sets of information and to get a clear understanding of clients’ needs.

If brokers could have everything important living in one cloud-based system, duplication of information will be eliminated, and it will be easier for them to find what they need at the drop of a hat.

Utilising a cloud-based system also allows access the information you need anytime, anywhere. Gone are the days of being tied to your desk.

So, imagine how much more a broker could achieve if tech was easy to use and another three hours a day became available.

Not only will they have more time to service clients and really get to know their needs, but they’ll also have more time to take on more clients, helping them to hit targets more easily.

2. Adhere to compliance

Compliance is one of the trickiest bits of the insurance job. Regulations change all the time, and it’s a broker’s job to make sure that they, their firm and their clients are safe.

However, adhering to compliance at every step of the customer lifecycle is not only a drain on productivity, but it also takes away from actually servicing clients.

Technology should remove this burden of confusing regulation, not add to it.

Up-to-date platforms should enable brokers to move with the times by progressing with the landscape as it changes.

They should also take care of compliance obligations automatically, so brokers don’t have to worry if they’ve followed the right approach should issues arise. Less time spent worrying means more time to focus on serving clients.

3. Make data-driven decisions

Being a trusted advisor has never been so important. But the tech that brokers are using probably doesn’t allow them to be the best they can be.

Given client, policy, and claims data tend to live in separate systems, trying to figure out what’s going on, and who needs the most help, is like trying to complete a daily jigsaw puzzle.

Modern technology that centralises all data offers a complete picture without having to put all the individual pieces together.

That means brokers can spend their time applying their expertise and understanding to each client — ultimately assisting them o make the right risk management decisions.

They can feel confident in their decision-making knowing they’ve built trust by helping customers protect what matters most.

Doing the heavy lifting

All in all, brokers are the support that Australians need right now. But the industry urgently needs to address the tech issues that are holding it back.

The number one way we can achieve this is by evolving with the world and allowing technology to do the heavy lifting.

I encourage all brokers to challenge the status quo, so they can get on with what’s most important and ultimately, get the job done.

This article was originally published in ANZIIF.

Related Articles

-

By Dale Smith, CEO JAVLN Data has been the lifeblood of modern businesses across the world for the past 20 years. It’s helped transform entire industries, from agriculture to banking,…Read more

By Dale Smith, CEO JAVLN Data has been the lifeblood of modern businesses across the world for the past 20 years. It’s helped transform entire industries, from agriculture to banking,…Read more -

Why technology is making insurance brokers more valuable than ever

By Dale Smith, CEO JAVLN. The recent federal budget probably left many small businesses across Australia banging their collective heads against a brick wall. While a few tweaks to the…Read more -

3 tips for insurance brokers tackling compliance in 2024

By Dale Smith, CEO JAVLN The Australian insurance industry has found itself in an interesting position in 2024. After a few years of intense storms, cyclones, flooding and bushfires, more…Read more