A lack of access to clear client data is holding brokers back and making sales and customer policy management less efficient, insurtech JAVLN says.

CEO Dale Smith told insuranceNEWS.com.au insured risks come with vast amounts of related data, but “more often than not, brokers can’t actually access that rich data set, because all of the information is actually held in systems or it’s held in the aggregation platforms’ systems.

“Data should be seen as an asset that is going to help not only the brokers’ business but their clients as well. Without that easy access, it is holding the industry back.

“You can’t analyse, you can’t group data together – there’s just no way to actually get it to do anything for you.

“The data exists. It’s just not at a place that brokers can access and monetise it because all of the risk information is in the insurance systems, or it’s on aggregation platforms like Sunrise. So it exists – it’s about making sure they have access to it when they want to.”

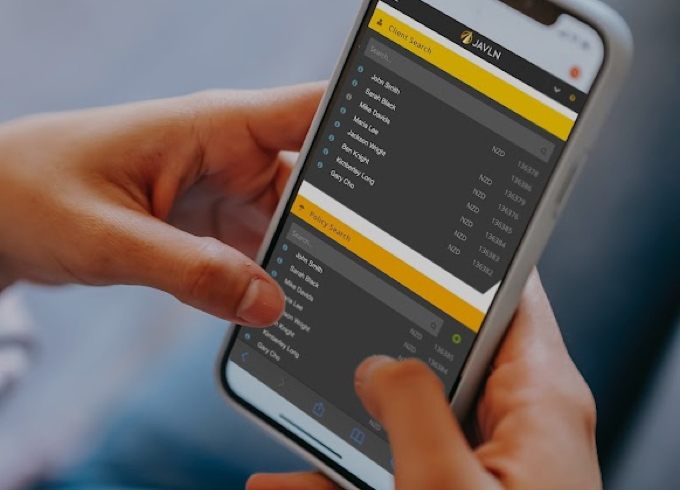

JAVLN, founded in 2011, offers a secure, cloud-based policy management platform accessible on any device. It is headquartered in Auckland and has IT staff in Melbourne and Brisbane after acquiring Underwriter Central from Steadfast and workflow software OfficeTech.

Clear and concise data sets can create new sales opportunities, and help brokers determine if they are providing the right level of advice to customers about their changing risks, yet many legacy software systems do not make this available, Mr Smith says.

“Let’s say something changes – either legislation or in market – partway through the policy term; there’s no way to interrogate your data set to figure out who the customers are that you need to get in contact with to make sure they’ve got the right level of cover.

“There’s just no way to get accurate and valuable data out of these legacy systems and it’s holding insurance brokers back.”

The JAVLN system is designed to collect data at risk level in a structured and detailed format. Users can determine with a couple of clicks what policies customers have, what potential upsell opportunities exist, and customer conversation pointers.

It can also help monitor compliance as requirements change, and check brokers asked the right questions and made the right disclosures.

“Insurance brokers need to be demanding data sets that they can use to get around their businesses. The technology is there to really monetise the data asset,” Mr Smith said.

This article was originally published in Insurance News.

Related Articles

-

Cloud technology can help insurers revolutionise productivity, data-driven decision making, customer service and compliance. 8 in 10 (77%) brokers do not feel equipped to be as productive as possible 70%…Read more

Cloud technology can help insurers revolutionise productivity, data-driven decision making, customer service and compliance. 8 in 10 (77%) brokers do not feel equipped to be as productive as possible 70%…Read more -

JAVLN announces new CEO appointment for next phase of growth

The JAVLN Board has appointed David Leach as the new CEO, from Monday 14 October 2024. David will succeed JAVLN Founder and current CEO, Dale Smith, as he assumes the…Read more -

OfficeTech by JAVLN announces refreshed brand and software integration

JAVLN, the cloud-based insurance policy management platform, has announced the next stage of its 2023 acquisition of Technosoft Solutions’ document management and workflow software. The well-known Officetech suite of products,…Read more