By Dale Smith, CEO JAVLN

Data has been the lifeblood of modern businesses across the world for the past 20 years. It’s helped transform entire industries, from agriculture to banking, making organisations more agile, effective, and resilient every day.

Financial services as a whole has seen a huge boost to services thanks to data. Many sectors in the industry have been quick to jump on the benefits of using data and have led the way in terms of shaping what’s possible. The insurance broking industry has been one of those areas however it would be described as taking more of a ‘step’ than a ‘jump’ as there is still so much untapped potential.

Insurance brokers are sitting on a treasure trove of customer information, risk details and information and some aren’t fully capitalising on the endless possibilities this information presents. Here are just three examples of what brokers can do with their data to perform their roles even more effectively.

1. Enhance the customer experience

Keeping clients happy means giving them a smooth and proactive experience. With the right data, technology can remind brokers when clients’ insurance is up for renewal and set a time for a call and even pull together relevant new policy terms from providers. This saves time and makes sure clients feel cared for, enhancing relationships and client’s tenure.

2. Find new opportunities to make money

Data can also help brokers find new revenue streams. With the right data, brokers can easily take advantage of cross sell opportunities. For example if a client has a particular type of policy, this might open up cross sell opportunities for other policy types to the same client.

3. Proactively managing accounts receivable/debtors

Managing debtors well is important for keeping cash flow steady. By looking at data on debtors, brokers can find clients who are slow to pay. With this knowledge, brokers can offer different payment options or send reminders automatically to different types of debtors to encourage on-time payments. This can reduce the number of days debts are outstanding and improve the brokerage’s financial health.

How to get the right data?

Given that the data is so powerful and offers so many opportunities, the obvious question now for any broker should be “how can I get my hands on the right kind of data”?

The first step is to really get to know your customers. For business customers, that means understanding not just the size and location of the company, but also the industry, goals, and challenges. For individual clients, it’s about knowing more than just age, address, and gender — it’s about knowing what kind of lifestyle they lead, what stage of life they’re at, what their housing situation is, whether they’ve got a family, and what their attitudes towards risk are.

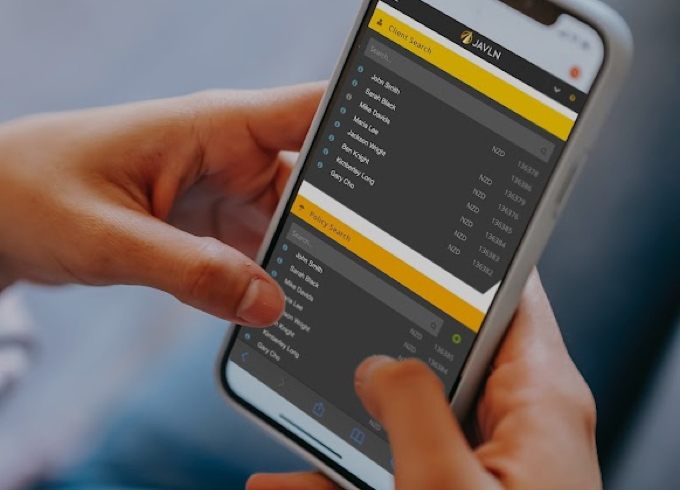

The second step is to use modern technology to centralise and store all this information alongside policy information. In most broking firms in Australia, customer and policy information lives in multiple systems, making it difficult to marry up information and draw trends, insights and actions from it. But with a centralised place to store everything, technology can join the dots easily and flag actionable insights quickly.

To gain a competitive advantage, broking firms need to look at the current state of their technology and if it is enabling them to use their data to their full advantage. According to JAVLN’s Brokering Change report, one in four brokers (27%) say the technology they use to manage clients and policy information is too confusing, and one in four (23%) go as far as to say that the technology currently serving the insurance broking industry is “not fit for purpose any more”.

This confusion and frustration no longer needs to be an issue. There are technology solutions designed for the insurance industry and although it might be relatively “new” to the insurance broking industry, the foundation on which this tech is built is not new to the world. That means there’s far less risk associated with it than what you’d get with a brand-new untried and untested system.

And so the tech race is now on in insurance broking and the potential for it to reshape and innovate the industry is huge. By using data to make more informed choices, enhance customer service, find new opportunities to make money, proactively manage debt, and recommend the best providers, brokers can better service their customers and get a big advantage over their competitors.

The key is getting the right data,really understanding customers and driving value from the data. And as the industry evolves, those who use data-driven strategies will be on a path of success.

This article was originally published in Australian Fintech.

Related Articles

-

By Dale Smith, CEO JAVLN. The recent federal budget probably left many small businesses across Australia banging their collective heads against a brick wall. While a few tweaks to the…Read more

By Dale Smith, CEO JAVLN. The recent federal budget probably left many small businesses across Australia banging their collective heads against a brick wall. While a few tweaks to the…Read more -

Customer service has become a broker’s number one challenge

By Dale Smith, CEO, JAVLN Insurance brokers in Australia are at the coalface of a changing world. On the one hand, natural disasters up and down the country are becoming…Read more -

3 tips for insurance brokers tackling compliance in 2024

By Dale Smith, CEO JAVLN The Australian insurance industry has found itself in an interesting position in 2024. After a few years of intense storms, cyclones, flooding and bushfires, more…Read more