Founded in 1975, Trans-West Insurance Brokers (Trans-West) is an Australian-owned and licensed general insurance brokerage firm serving commercial and industrial clients. Much of the company’s success over the past 45 years has been down to its unwavering approach to top-class customer service, built on a strong understanding of the insurance landscape.

The headaches caused by clunky technology

Part of Trans-West’s differentiators as a brokerage is how it deals with customers. Trans-West prides itself on getting to know each customer’s business in detail, seeking to form strong long-term partnerships and become a true strategic partner and advisor. But because of this commitment to customers, Trans-West found that it was grappling with several issues that were affecting the company’s capacity to take on new clients and drive bigger margins.

Pieter Versluis, general manager at Trans-West said:

“We were struggling with a fragmented system that made it incredibly difficult to get a full picture of our clients. Information was siloed in different locations, and there was no consistency in how we recorded client data. Keeping all of our files and communications organised and updating information across multiple systems was an onerous task. These challenges made it nearly impossible to provide the integrated client service we strive for.”

Summarising the challenges, Trans-West was faced with:

1. Inefficiency

The first issue was an inefficient allocation of time spent by brokers, who found themselves often wrangling with antiquated technology at the expense of helping customers and selling policies. With the existing setup, brokers would have to manually upload policyholders’ details, email trails, call records and other needs into numerous databases, which not only took up significant time, but also introduced duplication and errors.

2. Complexity

Disparate sources of information, inconsistent data and manual processes all added up to a complex way of working for brokers. Onboarding new employees took a considerable amount of time and effort, tracking down policyholder details was never as simple as it should have been, and keeping on top of what policyholders needed now and in the future was difficult. As a result, Trans-West’s brokers were missing opportunities to renew existing policies in a timely manner, upsell further policies and maintain customer satisfaction.

3. Compliance

The final issue was the way the complex technology setup left brokers to deal with onerous compliance requirements with very little help. Brokers needed to ensure compliance by manually capturing the right client information, saving documents in the right place, notifying the client with specific updates, and much more. As such, compliance was never too far from Trans-West’s brokers’ minds at every step of the insurance brokering process.

Upgrading to 21st-century insurance technology

Trans-West refused to accept the status quo, and chose to embark on a journey to empower its brokers to better serve customers. Viewing technological innovation as an enabler of, rather than a replacement for, brokers, Trans-West’s strategy focused on fixing the root cause of its challenges — its technology infrastructure.

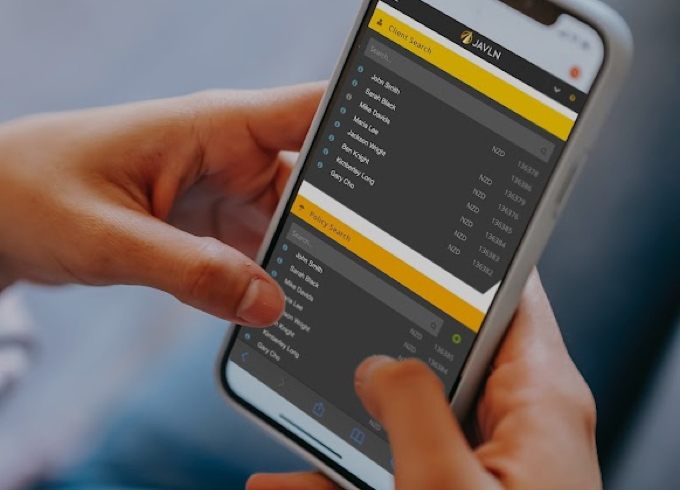

The company consulted with its own operators on what they needed from technology to be able to succeed in their jobs. Trans-West then began assessing the insurtech market for a solution, and after reviewing some competitor tools that the team found clunky, Trans-West replaced its existing disparate tech platforms with JAVLN’s all-in-one platform in 2019.

With JAVLN, Trans-West centralised all its policyholder details, communications, policies, renewal dates and other key data in one place — while also helping the company to go almost completely paperless.

Sandra Barrett, operations manager at Trans-West, said:

“Moving to JAVLN was a remarkably smooth transition for our team. The move caused very little disruption to our day-to-day operations, and the intuitive and user-friendly interface enabled our staff to get up to speed within just a week of training. We faced very few of the change management challenges we had anticipated based on previous system upgrades. I was impressed by how fluidly everyone was able to adapt.”

The ability to achieve more

The implementation of JAVLN’s easy-to-use platform helped Trans-West’s brokers become more efficient and effective — while also fixing the root cause of many of its technical- and business-level challenges in one fell swoop.

1. Client-centric insurance

The primary benefit of JAVLN is how it has helped Trans-West’s brokers put its customers first. With JAVLN, Trans-West removed the technical complexity involved with managing client information in various platforms, freeing up brokers to focus on what they do best — broking. JAVLN has also helped Trans-West’s brokers provide a personal touch to clients with bespoke documentation (through editable templates), that have contributed towards Trans-West’s 90% client retention rate.

2. Compliance made easy

JAVLN’s platform takes the stress away from compliance requirements by baking compliance in at every step of the broking process, from starting a relationship with a new client to managing renewals and claims management. JAVLN takes care of compliance through time-stamping, highlighting mandatory fields, and integrating client correspondence, giving peace of mind to brokers. In addition, JAVLN helps Trans-West demonstrate compliance easily to customers and regulators, reduce professional indemnity exposure, and maintain its reputation as a client-centric organisation.

According to Sandra Barrett: “JAVLN has made a huge difference to our ability to audit ourselves and demonstrate compliance because the platform doesn’t allow our brokers to do things they’re not supposed to during any part of the policy lifecycle. That really helps us at a management level for our compliance and breach reporting requirements.”

3. Measurable improvement to productivity

The combination of JAVLN’s easy-to-use and input-once platform has directly led to a huge 20% improvement to productivity. Brokers were no longer spending time managing compliance or technology — instead technology became an enabler to better work, rather than a hindrance to it.

4. Increase in client capacity

Thanks to the increase in productivity, Trans-West found that it was able to take on more clients with the same number of brokers and resources available, enabling the company to grow its footprint, sell more insurance and improve its profitability.

On capacity, Pieter said: “Earnings per full-time staff member has increased by 8% since we went to JAVLN. That has been one of the biggest wins for us using JAVLN — it has directly improved our bottom line.”

Why you should take the plunge

“JAVLN has been a game changer for our brokerage. Its user-friendly interface and client-centric approach have significantly improved our efficiency and enabled us to take our customer service to the next level. The continuous development and support from the JAVLN team has made this partnership invaluable.” — Pieter Versluis, general manager, Trans-West

Interested to learn more about how JAVLN can improve productivity and the bottom line in your brokerage? Book a demo with our team today.