By Kathryn McClunie, BDM.

Hardly a day goes by without talking to an insurance broker looking for a Customer Relationship Management (CRM) solution. Surprisingly, when I ask brokers what they require from a CRM, their answers vary significantly. This disparity highlights a fundamental issue: understanding what you genuinely need in a CRM is crucial for your success as a broker.

While CRM platforms offer a broad range of capabilities, they often represent a significant investment and require substantial resources to maintain. I recently ran a poll asking what features brokers look for from a CRM, and the top 3 were:

- Task & workflow management (59%)

- Deeper, richer client information (29%)

- Managing prospects (10%)

It’s no surprise that brokers are looking for these features; in our Brokering Change report, we found that 70% of brokers spend over 3 hours a day on admin tasks. 27% found that their current tech stack provides limited data on their clients and their needs, and 27% of brokers say the technology they use to manage prospects, clients, and policy information is too confusing.

Brokers should look for integrated insurance-specific solutions

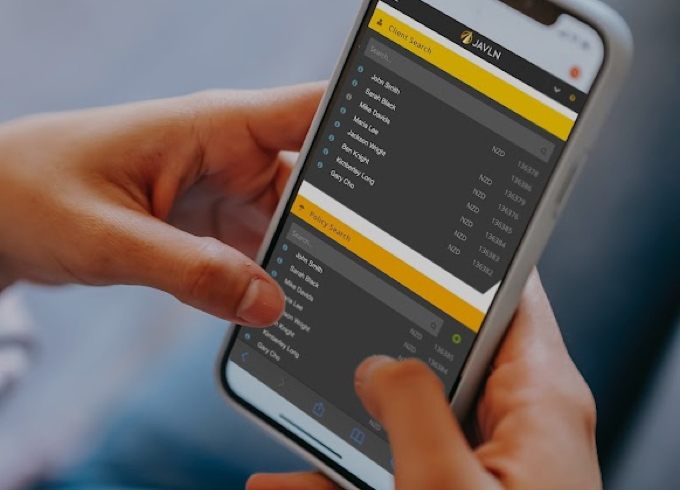

According to our research, 30% of brokers wish they could spend more time talking to clients and prospects instead of entering data into their systems. Integrated insurance-specific solutions like JAVLN and JAVLN Officetech can significantly reduce the admin and data entry time for brokers, as they don’t need to worry about rekeying data. They are specifically designed with the insurance industry in mind and address the key features that brokers are looking for in a CRM (task and workflow management, deeper, richer client information and managing prospects).

JAVLN: Enhancing Client and Prospect Management

- Client Segmentation: JAVLN enables you to segment your client base effectively, allowing for tailored engagement strategies.

- Customisable Client Profiles: With configurable question sets, JAVLN ensures that you can capture detailed, unique client requirements, enhancing your service quality.

- Prospect Management: By capturing essential information such as due dates and holding brokers, JAVLN ensures that you never miss an opportunity to secure an account.

OfficeTechNow: Streamlining Workflow Management

- Customised Workflows: OfficeTechNow allows you to create business-specific process workflows, such as for new business or cancellations. This capability provides real-time insights into task statuses and workforce productivity, all without the need for extensive customisation or investment.

JAVLN and OfficeTechNow: Better together

- Integrated Solutions: All new clients, policies, and claims created in JAVLN are also created in OfficeTechNow in real-time, and policy documentation generated in JAVLN is automatically filed in OfficeTechNow.

Clarifying your CRM needs

So, what do you truly want from a CRM? It’s crucial to clearly identify your requirements, as the solution might be simpler than you think. By focusing on the core functions that address your immediate challenges, you can avoid overcomplicating your CRM strategy and make a more informed, effective and timely decision.

If you’re interested in discussing your specific needs and how JAVLN and JAVLN Officetech can support your business, book a demo here. Let’s simplify your path to success together.

Related Articles

-

By Kathryn McClunie, Business Development Manager. Insurance brokers in Australia and New Zealand face a constant flow of documents, emails and tasks from clients. Staying organised can feel like a…Read more

By Kathryn McClunie, Business Development Manager. Insurance brokers in Australia and New Zealand face a constant flow of documents, emails and tasks from clients. Staying organised can feel like a…Read more -

Why the Cloud is a Game-Changer for Insurance Broker Security

By Matt Sealy, Chief Product Officer, JAVLN In today's digital environment, whether your systems are on-premise or cloud-based, data security is essential. With rising cyber threats, ransomware, and data theft,…Read more -

Addressing Your Concerns About Moving to the Cloud

Moving to the cloud is a big decision, and it’s normal to have concerns. At JAVLN, we’ve heard all the common questions about security, cost, and change, so we’re here…Read more