Emma Scoringe, CMO, JAVLN

When choosing between server-based and cloud-based software, cost may be the first consideration. Server-based software may seem more affordable upfront, the long-term costs can add up like an iceberg, hiding most of its bulk beneath the surface.

Breaking Down the Costs

With server-based tech, initial expenses are straightforward: you pay for the hardware, software licences and IT support. But hidden costs like maintenance, unexpected repairs and cooling rooms for servers can mount quickly and you might need managed services like security and backups.

Cloud technology operates on a subscription-based model. Meaning you pay a predictable monthly or annual fee and avoid any headaches of hardware maintenance. You’ll also get automatic updates and ongoing support, to keep your business running smoothly without the need for costly upgrades.

Why Cloud is More Cost-Effective in the Long Run

Over time, the total cost of ownership for cloud software is significantly lower than server-based software. With the cloud, you save on hardware, IT costs and unexpected expenses, while investing in software that scales with your business.

Ensuring Security and Efficiency

Regular updates for your cloud solution is like updating your phone — each update improves security and adds new features to make the system better. With cloud, updates happen regularly to keep your business safe and running without manual installations.

Supporting a Customer-Centric Model

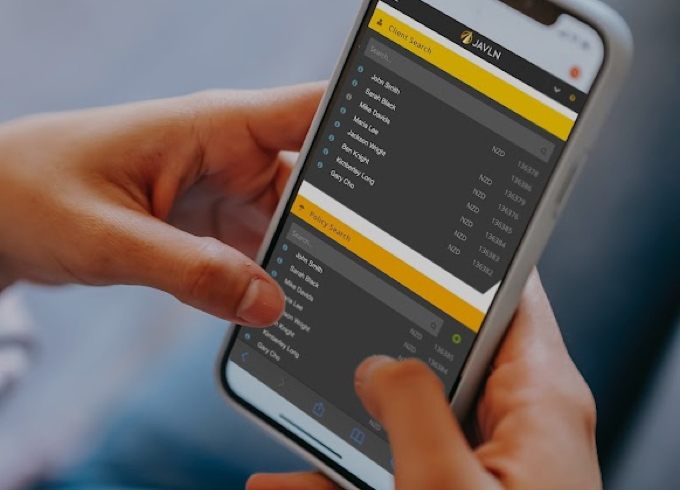

Moving to the cloud supports a customer-centric business model, where the team spends less time on admin and more time focusing on delivering value to clients. Cloud policy management platforms give easy access to real-time data, so insurance brokers can respond quickly to clients.

Gain a Competitive Advantage

Leveraging cloud technology gives an advantage. It allows you to stay agile, adapt to industry changes and outperform competitors who may still be limited by server-based systems.

Choosing cloud-based software over on-premise technology isn’t just about cost — it’s about future-proofing your brokerage, just like keeping your phone secure with the latest updates.

Related Articles

-

By Kathryn McClunie, Business Development Manager. Insurance brokers in Australia and New Zealand face a constant flow of documents, emails and tasks from clients. Staying organised can feel like a…Read more

By Kathryn McClunie, Business Development Manager. Insurance brokers in Australia and New Zealand face a constant flow of documents, emails and tasks from clients. Staying organised can feel like a…Read more -

Why the Cloud is a Game-Changer for Insurance Broker Security

By Matt Sealy, Chief Product Officer, JAVLN In today's digital environment, whether your systems are on-premise or cloud-based, data security is essential. With rising cyber threats, ransomware, and data theft,…Read more -

Addressing Your Concerns About Moving to the Cloud

Moving to the cloud is a big decision, and it’s normal to have concerns. At JAVLN, we’ve heard all the common questions about security, cost, and change, so we’re here…Read more