By Matt Sealy, Chief Product Officer, JAVLN

In today’s digital environment, whether your systems are on-premise or cloud-based, data security is essential. With rising cyber threats, ransomware, and data theft, protecting sensitive data and personal information must be a top priority for all organisations in the insurance industry. Customers need assurance their data is safe and well-guarded in your hands.

The Importance of Secure Policy and Claims Management Systems

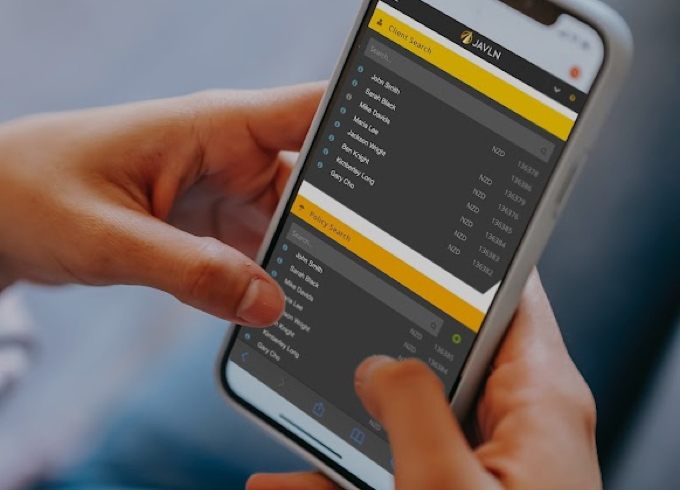

Policy and claims management systems are the core of daily business operations for insurance brokers. It’s crucial these systems meet the security needs of your brokerage but also comply with Australian and New Zealand legislation, such as the Privacy Act. Security is not just about protecting data, it’s about fulfilling legal obligations and earning the trust of your customers.

With different security considerations for cloud-based and on-premise solutions, it’s important to recognise that neither option inherently guarantees complete security. What really matters is your approach to security.

Key Security Considerations for Insurance Brokers

When assessing security, ask yourself:

- Am I partnering with a security-conscious software vendor? Look for vendors who have undergone rigorous security assessments, such as SOC-2 Type 2 or ISO 27001.

- What types of security matter to my business? Think about software security, user access controls, and physical access to data.

- Does my business have robust security policies? Regularly update and review your policies, and ensure staff receive regular reminders about best practices.

- Is my cloud software provider reliable? Partner with vendors that collaborate with leading cloud providers like Amazon or Microsoft, who focus heavily on security. JAVLN’s cloud applications, for example, leverage these trusted providers to enhance security for our customers.

The Potential Costs of a Security Breach

Consider the impact if your business were to experience a security incident. Downtime can be costly, but the most significant damage often comes from the loss of reputation. According to Norton Security, a security incident can cost a small to medium business an average of $19,000, with some ransomware incidents amounting to hundreds of thousands of dollars. Other impacts include:

- Downtime and lost productivity: Time spent recovering from a breach can disrupt operations and revenue.

- Customer trust and retention: Customers may be less likely to continue doing business with a company that has suffered a security lapse.

- Partnerships and competitive positioning: Security issues can affect existing business relationships and reduce your competitive edge.

Can Your Business Withstand a Security Incident?

- Could your operations survive three to five days of downtime?

- What would happen if you made headlines for the wrong reasons?

Cloud vs. On-Premise: Which is More Secure?

In general, cloud solutions tend to offer more robust security than on-premise systems. Here’s why:

Cloud computing offers significant advantages for insurance brokers across Australia and New Zealand to stay one step ahead.

Related Articles

-

By Kathryn McClunie, Business Development Manager. Insurance brokers in Australia and New Zealand face a constant flow of documents, emails and tasks from clients. Staying organised can feel like a…Read more

By Kathryn McClunie, Business Development Manager. Insurance brokers in Australia and New Zealand face a constant flow of documents, emails and tasks from clients. Staying organised can feel like a…Read more -

Addressing Your Concerns About Moving to the Cloud

Moving to the cloud is a big decision, and it’s normal to have concerns. At JAVLN, we’ve heard all the common questions about security, cost, and change, so we’re here…Read more -

The Real Cost of On-Premise vs. Cloud Insurance Software

Emma Scoringe, CMO, JAVLN When choosing between server-based and cloud-based software, cost may be the first consideration. Server-based software may seem more affordable upfront, the long-term costs can add up…Read more